Torben Aksel Sørensen | COO Nordics | CountMatters

RETAIL FOOTFALL ANALYTICS: FROM GUT FEELING TO DATA-DRIVEN DECISIONS

Primary keyword: retail footfall analytics. Outcome: consistent, privacy-safe visitor insights that improve conversion, staffing, and tenant reporting for stores and shopping centres with CountMatters’ people-counting sensors and dashboards.

THE PROBLEM: GUT FEELING CAN’T SCALE

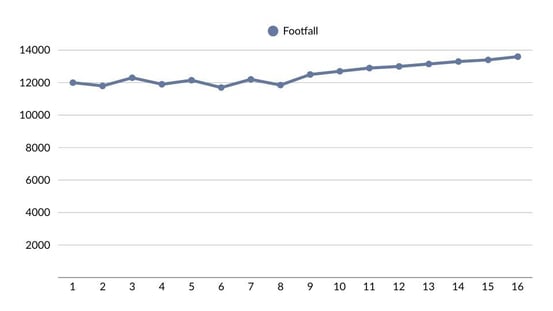

Merchandising tweaks, price changes, and staffing calls often rest on hunches. But when footfall softens and shopper habits shift, guessing turns risky. Recent data shows multi-month volatility in physical visits across Europe and the UK, with high streets and malls feeling the pressure while retail parks stay steadier. That makes it harder to judge whether weak sales reflect lower traffic, poor conversion, or both.

THE SOLUTION: COUNTMATTERS TURNS VISITOR DATA INTO ACTION

CountMatters replaces anecdotes with measurable footfall analytics and occupancy monitoring. Using 3D people-counting sensors and optional Wi-Fi analytics, we capture entrances, dwell, and flow patterns—then surface them in dashboards your team actually uses.

- Staffing & service: Align schedules with real traffic peaks to reduce queues and lift conversion.

- Layout & mix: See heat, dwell, and missed-opportunity zones to fix friction and test new adjacencies.

- Tenant reporting: Provide consistent, trusted KPIs to every tenant—weekly, monthly, quarterly.

- Campaign measurement: Compare like-for-like periods and entrances to prove uplift, not just impressions.

PROOF: A FEW HARD NUMBERS

- Footfall pressure is real: UK retail visits fell year-on-year across 2024, including a 2.2% decline in December YoY and softness through the golden quarter, according to British Retail Consortium (BRC) data. Shopping centres saw some of the largest drops.

- Small conversion lifts matter: Industry research shows that even a modest conversion uptick can deliver outsized profit growth—often without more traffic—by monetising the footfall you already have.

- Scheduling impacts productivity: Peer-reviewed research links more predictable, worker-friendly scheduling to measurable store productivity gains—supporting data-driven rostering.

- Occupancy data has cross-functional value: Real-time occupancy/footfall streams inform not only sales and service but also facility decisions (e.g., HVAC optimisation), reinforcing the ROI of accurate, privacy-safe counting.

USE CASES ACROSS RETAIL, VENUES, TRANSPORT, PUBLIC SPACES

RETAIL & SHOPPING CENTRES

Measure entrances, dwell, and conversion; compare tenants; create fairer rents and marketing fees. Replace anecdotal feedback with transparent, shared KPIs.

Explore Retail Solutions — Boost Conversion

VENUES & EVENTS

Track peak times and live occupancy to optimise staff, wayfinding, and security. Validate sponsorships with verified visitor counts.

TRANSPORT HUBS

Understand flows between gates, platforms, and retail. Improve queue design and concession planning with sensor-based insights.

PUBLIC SPACES

Measure usage of plazas, parks, and libraries to inform investment and programming—using privacy-first, aggregate reporting only.

IMPLEMENTATION: SENSORS, DASHBOARDS, PRIVACY

- Survey: Doors, zones, ceiling height, lighting; confirm network and data-retention rules.

- Install sensors: 3D people-counting sensors at entrances and key choke points; optional Wi-Fi analytics for repeat-rate/flow trends.

- Connect data: Dashboards and APIs for BI tools; scheduled tenant exports by email or portal.

- Governance: Document DPIA, retention, and access; keep everything anonymised and aggregated.

- Enable teams: Train centre management, tenants, and store managers on KPIs and routines.

ROI & OPERATIONAL IMPACT

Footfall analytics pays back by improving conversion (right people at the right time), reducing abandonment (shorter queues), and reallocating budget toward channels and layouts that actually move visitors into buyers. It also strengthens landlord–tenant trust with objective, repeatable reporting.

MINI-FAQ

- How accurate are the sensors?

- Modern overhead 3D people-counting sensors typically deliver high accuracy in varied lighting and doorway conditions when installed to spec and routinely validated. CountMatters calibrates and audits for each site.

- What about privacy and GDPR?

- We do not identify individuals. We collect and present anonymised, aggregate metrics only, with documented DPIA, access controls, and retention limits.

- How fast can we start?

- Single stores can be live in days after survey. Multi-site malls/portfolios follow a phased rollout with standardised templates and training.

- What does it cost?

- Budgets vary by entrance count and reporting scope. Most clients see ROI through higher conversion and better tenant relations rather than more media spend.

- Can we integrate with BI and POS?

- Yes. We provide exports and APIs to connect visitor and occupancy KPIs with POS, staffing, and marketing data for end-to-end funnel analysis.

CONCLUSION

Retail footfall analytics turns uncertainty into a repeatable operating system. With CountMatters, every stakeholder—store managers, centre management, and tenants—works from the same privacy-safe KPIs to improve service, conversion, and revenue. The era of guesswork is over.

Tags:

public, Combined solutions, Transforming with Footfall Data: A German Shopping, cities, people counter, BLOG, wifi, See All, outdoor pool, All Posts, Conversation rate, Museum, parking system, contact, traffic lights, personal planner, Fairs & Exhibitons, People Flow, Shopping center, capture rate, xovis3d, staff planner, possibilities on our website, Video, General, store, Parks & resorts, Why is it so important to know visitor frequency a, Get to know IMAS, Naoufal Chaghouani: His Role at IMAS Group and the, Hjalmar Brage, IMAS Group, Real-time Occupancy, retail, visitor data, Career

Jan 13, 2025 5:55:42 PM

Comments